Why Warren Buffett Was One of One

Warren Buffett steps back, but his investing playbook lives on. Here’s what it means for Berkshire — and for your money.

Warren Buffett Just Passed the Torch — And It’s Bigger Than a Title Change

Berkshire Hathaway’s legendary leader is stepping aside, and the investing world is watching closely.

Warren Buffett is more than a CEO — he’s the blueprint for long-term wealth building. Now, after nearly 60 years, he’s officially handing off the Chairman role. But this isn’t just corporate housekeeping. It’s a moment that forces us to ask:

Does the Buffett way still work in 2025? Let’s find out!

Yours truly,

Kayla | Your Fintech Insider

P.S. Our blog’s packed with more wealth gems — don’t miss it.

Why Warren Buffett Was One of One

After nearly 60 years of steering Berkshire Hathaway, Warren Buffett is officially stepping aside as Chairman. He’s not leaving entirely — he’s still CEO — but this handoff marks a defining moment in modern investing.

Buffett isn’t just any executive. He’s the most studied investor in history. His transition is more than a company update — it's a shift in the psychology of long-term investing.

Let’s break down what this moment means: for Berkshire, for financial markets, and for everyday investors like you.

He’s Stepping Back — But Not Away

At the 2025 Berkshire Hathaway shareholder meeting, Buffett confirmed he’s passing the Chairman role to Greg Abel, the executive who has overseen the company’s non-insurance operations for years.

Abel isn’t just a fill-in. He’s been groomed for this moment and carries Buffett’s confidence fully. Berkshire’s leadership plan has been in place for years, but this formal move signals the company’s belief in continuity over reinvention.

“Greg is ready. The values of Berkshire won’t change,” Buffett said. “The culture is too deeply embedded to fade.”

Buffett remains CEO for now, but his message was clear: Berkshire is built to run without him. And that’s exactly how he designed it.

Buffett’s Blueprint: A Financial Masterclass

Warren Buffett’s value as an investor isn’t just in his returns — it’s in the philosophy behind them.

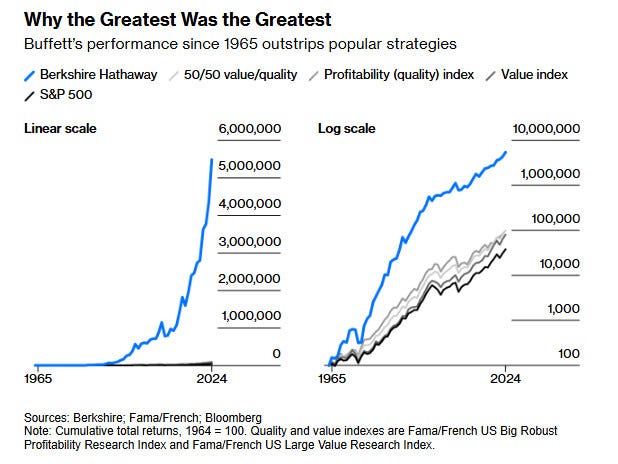

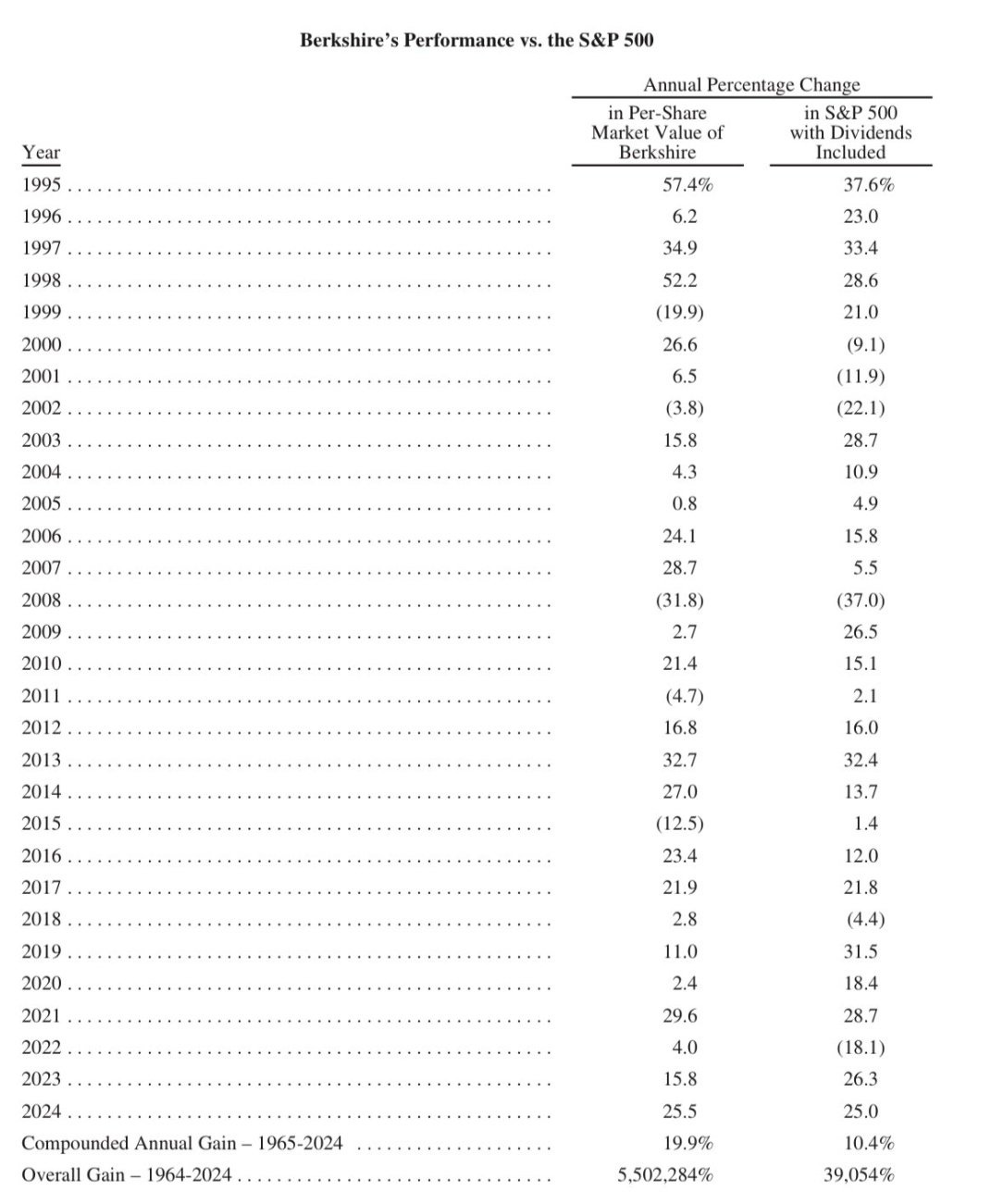

When he took over Berkshire in 1965, the stock traded at about $19 per share. Today, it trades above $600,000 per Class A share. That growth didn’t come from hype or speculation. It came from a disciplined approach based on a few timeless principles:

Buy wonderful businesses at fair prices.

Buffett doesn’t chase the hottest stocks — he finds durable companies with strong cash flows and economic moats (think Apple, Coca-Cola, American Express).

Let compounding do the heavy lifting.

He’s famously said his favorite holding period is forever. That long-term view allowed Berkshire to benefit from decades of compound returns.

Avoid unnecessary risk.

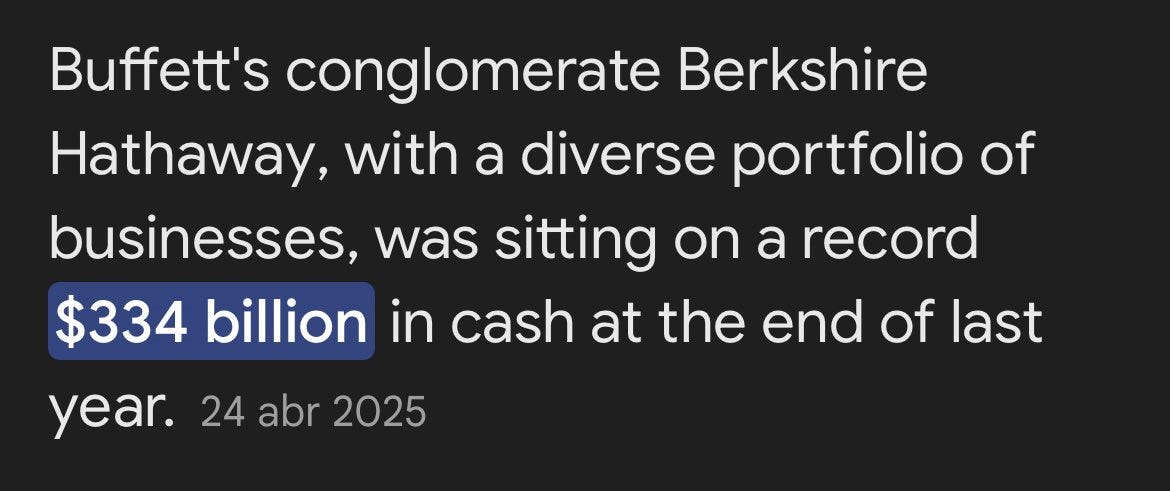

Buffett treats cash like a strategic asset. Berkshire often holds over $100 billion in cash reserves — not out of fear, but to stay ready for opportunity.

Don’t follow the crowd.

He underweights speculation and isn’t swayed by trends. During the dot-com boom, Buffett refused to chase tech valuations — a move that preserved Berkshire’s capital when the bubble burst.

This philosophy is why investors, analysts, and financial educators around the world consider Buffett’s shareholder letters required reading.

Warren Buffett’s Legacy

Warren Buffett didn’t just build wealth — he built trust.

He became CEO of Berkshire Hathaway in 1965, when it was just a failing textile mill. Over the next 60 years, he transformed it into a $900+ billion company that owns everything from railroads to Apple stock.

His investing approach? Simple, steady, and powerful:

Buy great businesses

Hold them long-term

Don’t panic when markets crash.

That mindset turned investing into something disciplined — not dangerous.

But Buffett’s impact goes beyond money. He led with trust. He gave his managers freedom to run their businesses. He built a culture where people were expected to do the right thing — even when no one was watching.

A lot of small-business owners said they sold to Berkshire because they trusted Buffett more than anyone else.

Warren Buffett didn’t just outperform the market.

He redefined what success looks like.

What This Means for You

This isn’t just a milestone for Berkshire Hathaway — it’s a mirror for all of us.

Buffett’s transition is a reminder that real wealth is built slowly, not loudly. His life’s work teaches us that investing isn’t about timing the market — it’s about time in the market.

So, here’s what you can take away:

✅ Think like an owner, not a trader.

Buffett looks for businesses he’d want to own forever. That mindset helps filter out hype and focus on fundamentals. You can apply the same principle when choosing ETFs, dividend stocks, or long-term holdings.

✅ Cash is not the enemy.

Buffett holds cash to stay ready, not out of fear. A healthy emergency fund — or dry powder in your brokerage account — gives you flexibility when opportunities strike.

✅ Be wary of trends and financial noise.

Buffett famously said, “The stock market is a device for transferring money from the impatient to the patient.” Stay grounded in research and avoid jumping into investments you don’t understand.

✅ Focus on compounding, not quick wins.

Whether it’s your Roth IRA, 401(k), or index fund portfolio — staying invested and consistent is where real wealth builds.

✅ Legacy matters.

Buffett isn’t just leaving behind money — he’s leaving a model of ethical business and lifelong learning. Your financial journey can also be rooted in impact, not just income.

Final Word

Buffett stepping down marks the end of a historic era — but it doesn’t mean his playbook stops working. If anything, his steady approach is more valuable in today’s noisy, fast-moving financial world.

Whether you're investing $100 or $100,000, the lesson is the same:

Keep it simple. Stay invested. Bet on what you understand. And never forget — time in the market is your greatest asset.

Your Turn: Is the Buffett Way Still Relevant Today?

Warren Buffett built his empire on long-term thinking, disciplined investing, and doing business with integrity. But in a world of meme stocks, AI hype, and 10-second attention spans — does his strategy still hold up?

Would you still follow Buffett’s principles in 2025 and beyond?

POLL: Is Buffett’s investing playbook still the way to build wealth?

✅ Yes – Value investing never goes out of style

💼 Maybe – But only if you’re investing long-term

🔄 Not really – The game has changed too much

📱 I just want investing tips from TikTok

Drop your answer in the comments or reply to this post.

I’d love to hear where you stand — especially in today’s market.

Disclaimer: All readers are advised to conduct their own independent research into Bitcoin or any related investment strategies before making an investment decision. Your FinTech Insider newsletters are NOT financial advice and are solely opinion pieces. Additionally, investors should note that past performance of investment products does not guarantee future price appreciation.