Google's New AI Mode, Trump Accounts for Newborns, & Crypto Bro Kidnaps Founder in NYC

Google’s AI is reshaping search, China’s housing crisis is shaking markets, and a crypto kidnapping shows digital money’s dark side. Plus, why “Trump accounts” for babies have experts divided.

AI, Baby Bonds, and a Bitcoin Kidnapping?! Let’s Talk About It.

Whether it's Google's AI rewriting the rules of search, China's housing crisis rippling through global markets, or lawmakers proposing “Trump accounts” for newborns, one thing is clear: the world of money is moving faster than ever—and if you’re not paying attention, you’ll get left behind.

This isn’t about chasing every headline. It’s about understanding why they matter to your wallet, your goals, and your future.

So, grab your coffee (or matcha), and let’s get into it.

No fluff. Just facts, clarity, and a little edge—like always.

Yours truly,

Kayla, Your Fintech Insider

P.S: Checkout our website’s new blog.

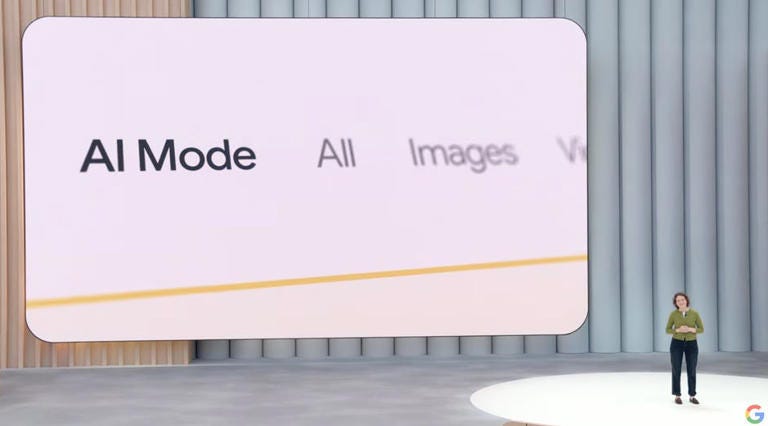

Google's New AI Mode Is Changing the Way We Search

At Google’s I/O 2025 event, Google officially unveiled “AI Mode” for Search—a game-changing update that replaces basic search results with conversational, intelligent responses.

Instead of a list of blue links, users will now get real-time summaries, context-aware answers, and more intuitive interactions powered by generative AI. Think of it as ChatGPT built directly into your search bar—with the backing of Google’s data dominance.

This move cements Google's push deeper into artificial intelligence, signaling that AI isn’t just the future of content creation—it’s the future of how we find and process information.

Expect to see more changes roll out soon as Google positions itself to compete with OpenAI, Perplexity, and other AI-native platforms. For everyday users and businesses alike, this shift could redefine everything from SEO strategy to how we shop, research, and learn online.

China’s Real Estate Meltdown

Imagine your favorite toy store stopped building shelves.

They don’t need wood, screws, or paint anymore. So the companies that make those things? They lose business—and everything slows down.

That’s what’s happening in China right now.

Two of the country’s biggest property developers—Evergrande and Country Garden—have defaulted on billions in debt. These companies once built entire cities. Now? Construction sites are paused, workers are unpaid, and apartments are left unfinished.

China’s real estate sector makes up nearly 30% of its economy. So when building stops, it doesn’t just affect China—it sends shockwaves across the world.

How it affects everyone else:

Less demand for raw materials: China is the world’s largest buyer of steel, cement, and copper. When construction drops, global prices fall—hurting exporters in places like Australia, Brazil, and South Africa.

Lower demand for luxury goods: Chinese consumers make up a huge chunk of global luxury spending (about one-third worldwide). When property values fall, people spend less on items like watches, fashion, and handbags.

Slower global growth: The IMF and World Bank have already trimmed their global GDP forecasts, citing China’s slowdown as a key reason. Economies that rely on selling to China—like Germany, Japan, and Korea—are also seeing slower growth.

Investor fear: Foreign investors are pulling back from China’s stock and bond markets. The yuan is under pressure, and confidence in China’s recovery is fading.

“Trump Accounts” for U.S Newborns

The House just passed a bill that would let parents open tax-free savings accounts for their newborns—nicknamed “Trump accounts” because the idea traces back to a 2020 Trump campaign proposal.

These so-called American Families Investment Accounts would work like baby Roth IRAs: Parents could contribute money tax-free, and the funds could grow over time to be used for things like education, a first home, or retirement.

On paper, it sounds like a win. But financial experts aren’t sold. Here’s why:

Built for the rich: Without government seed funding, these accounts mostly benefit families who already have money to invest—leaving lower-income households behind.

Redundant and unnecessary: With tools like 529 plans and custodial Roth IRAs already in place, some say this doesn’t solve any new problem.

Worsens inequality: Critics argue it will widen the wealth gap, accelerating tax-free growth for the wealthy while offering little for those who can’t contribute much (or at all).

Bottom line: This isn’t a baby bond for everyone—it’s a baby tax shelter for the privileged.

Would you use a financial tool like this for your child? Or does it miss the mark?

Crypto Bro Kidnaps Founder in NYC Over Bitcoin

A wild crypto story just broke in NYC—and it sounds like something out of a movie.

A U.S. crypto investor named John Woeltz allegedly kidnapped and tortured an Italian businessman, Michael Carturan, to steal his Bitcoin. Carturan flew to NYC on May 6, thinking it was a business trip. Instead, he was trapped in a luxury SoHo townhouse, beaten, drugged, and even threatened with a chainsaw.

Why? Woeltz wanted the password to his crypto wallet.

Carturan was held for nearly three weeks before finally escaping. He gave up the password and ran while Woeltz was distracted. Police arrested Woeltz shortly after. He’s now facing serious charges, and authorities say he’s a flight risk—since he owns a private jet and a helicopter.

Why it matters

This is what’s called a “wrench attack”—when someone skips the hacking and uses physical force to steal crypto. It’s a scary reminder that your digital money can make you a real-world target.

🗣️ Your Turn: What Do You Think?

We covered a lot this week—from Google’s AI-powered search overhaul to China’s property market fallout and a crypto crime straight out of a thriller. Now we want to hear from you:

💬 Which of these stories do you think will have the biggest long-term impact?

Google’s new AI Mode changing how we search?

China’s real estate slowdown shaking global markets?

The rise of "Trump accounts" and what they mean for future wealth?

Or the extreme risks tied to crypto ownership in the real world?

👉 Reply to this email or drop a comment in our latest Substack post.

We’ll feature some of your takes in next week’s edition!

Disclaimer

All readers are advised to conduct their own independent research into Bitcoin or any related investment strategies before making an investment decision. Your FinTech Insider Newsletters are NOT financial advice and are solely opinion pieces. Additionally, investors should note that past performance of investment products does not guarantee future price appreciation.